Facts & Stats

- NHoneybush, belonging to the Cyclopia species, originates from South Africa, primarily thriving in the Western and Eastern Cape provinces.

- NAll honeybush species fall under the Cyclopia genus. There exist 23 distinct honeybush species, each boasting a unique flavour profile and specific habitat preferences.

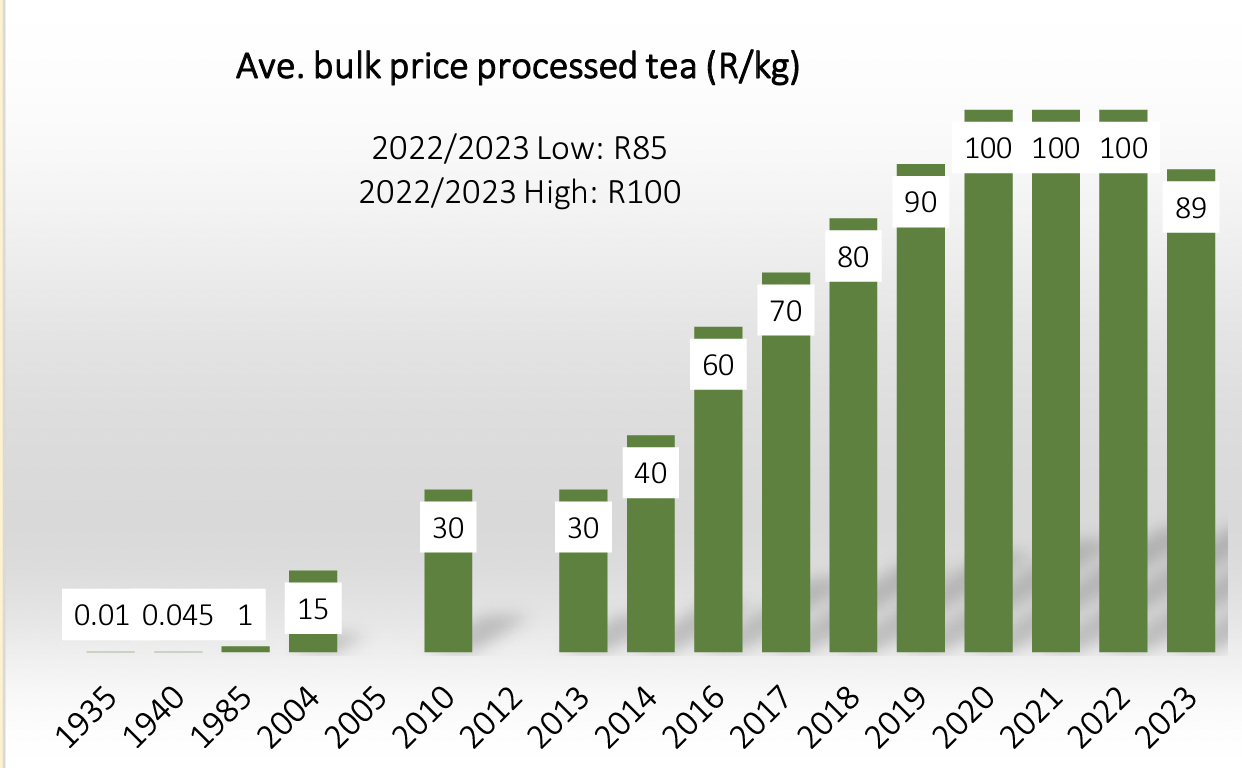

- NHoneybush tea, steeped in tradition, finds its historical roots dating back to 1705. As early as 1830, Cape colonists recognised its rejuvenating qualities.

- NFragrant yellow flowers grace honeybush plants, once integral to tea processing, inspiring names like "flower tea" or "blommetjiestee."

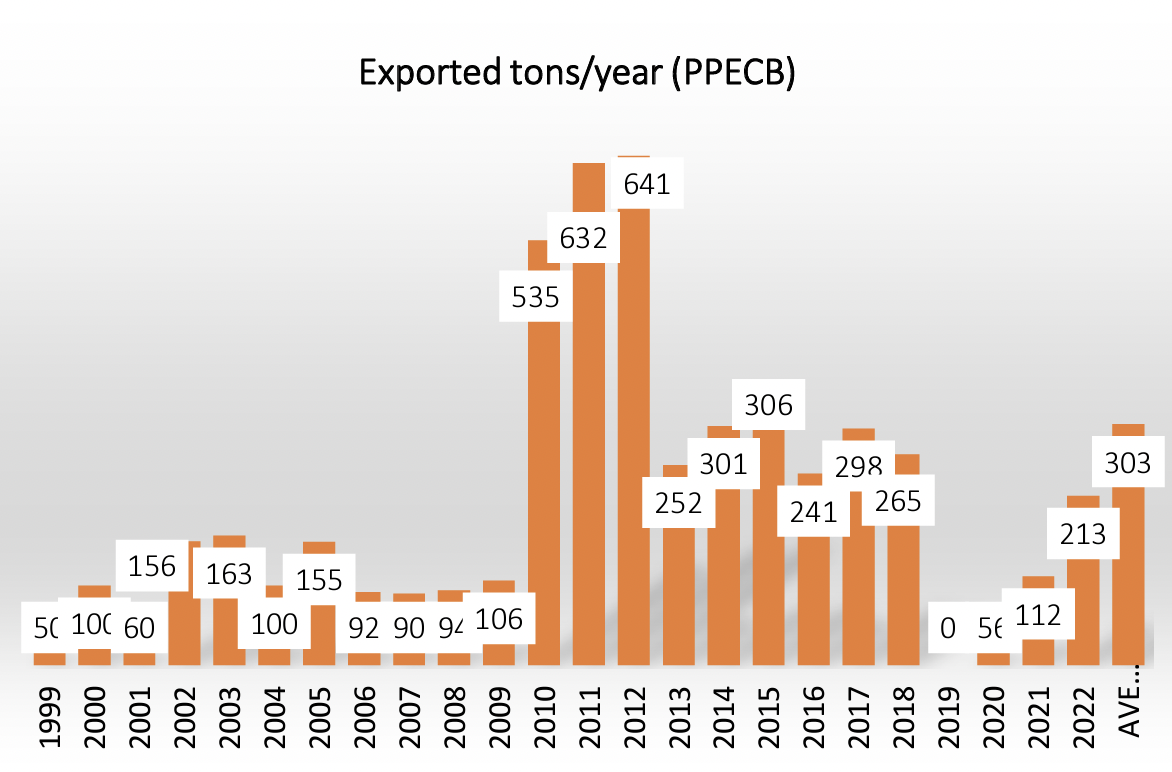

- NSouth Africa's honeybush industry, although young, annually produces several hundred tons of processed tea.

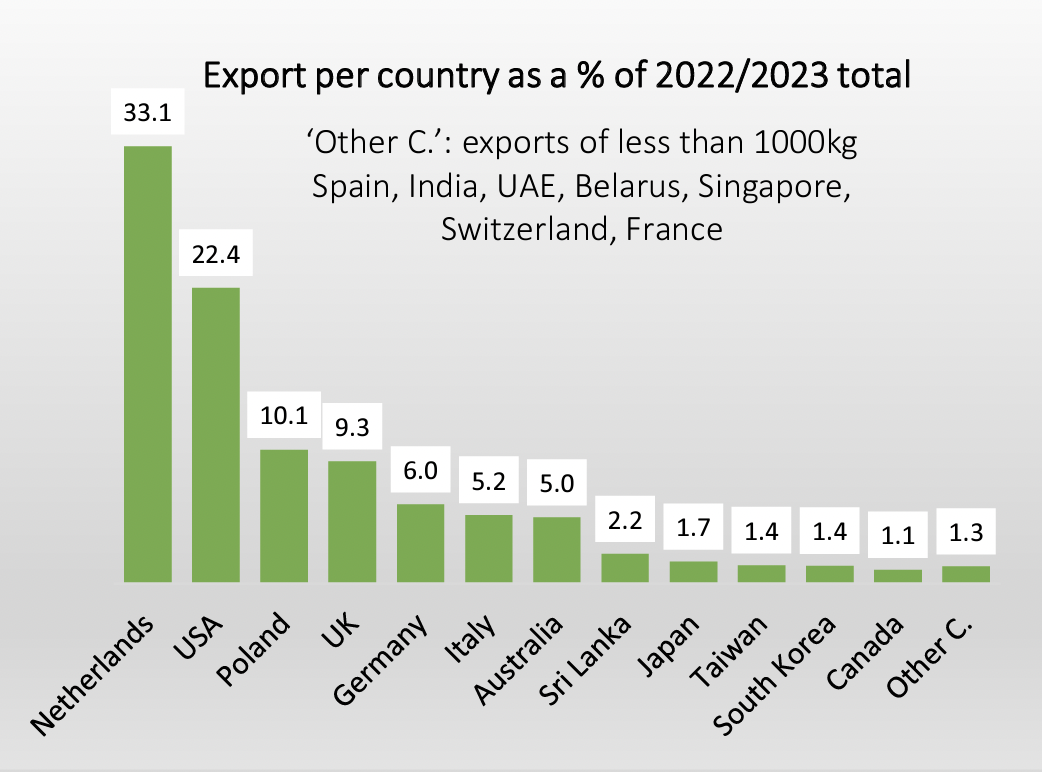

- NMost of the tea embarks on international journeys, finding its way to countries like the Netherlands, Germany, Japan, the UK, and the USA.

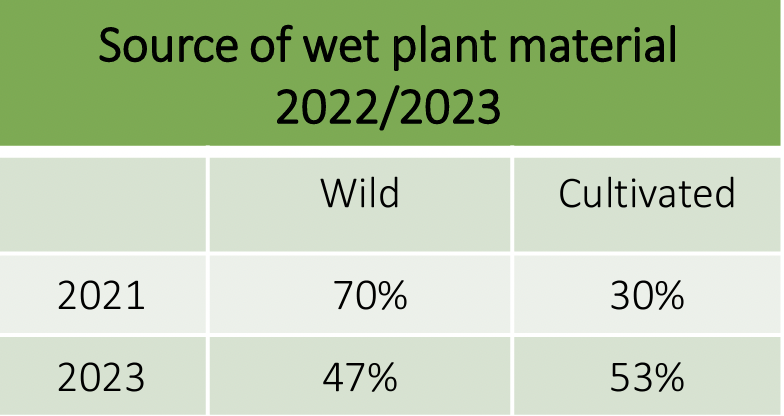

- NAround 53% of honeybush tea is sourced through wild harvesting, with ongoing initiatives to engage small and emerging farmers in cultivation.

- NProcessing entails meticulous steps, including sweating or fermentation, to unlock the tea's unique flavour and hue. It culminates in drying, sieving, grading, and packaging.

- NEach honeybush species contributes its distinct flavour, often prompting the blending of various species for product consistency.

- N"Green" honeybush tea, renowned for its lighter hue and distinct flavour, sidesteps the fermentation process, boasting higher antioxidant activity.

- NSustainability takes centre stage in the honeybush industry's efforts, with a transition to sustainable farming practices to alleviate pressure on wild honeybush populations.

- NPreserving biodiversity stands as a core commitment, ensuring the harmonious coexistence of South Africa's natural environment.

Factfile

This factfile of industry statistics will be compiled every other year by SAHTA. This version represents the results of interviews with industry stakeholders (mostly processors) conducted in April 2023 with reference to 2022 and 2023 figures. Other figures come from the Perishable Products Export Control Board (PPECB) and from existing published information.

Honeybush production

There are nine honeybush processors with an annual processed tea output ranging from 20 to 200 tons. Seven processors provided input to this survey. There are several small artisanal producers, (some of whom use traditional methods of processing) who produce less than one ton of processed tea per year whose figures are not included here.

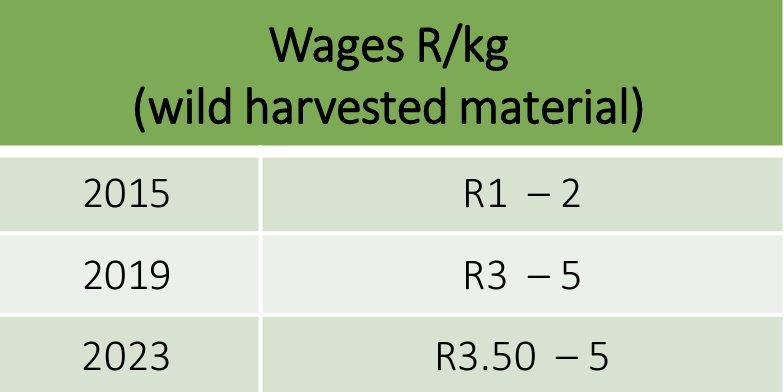

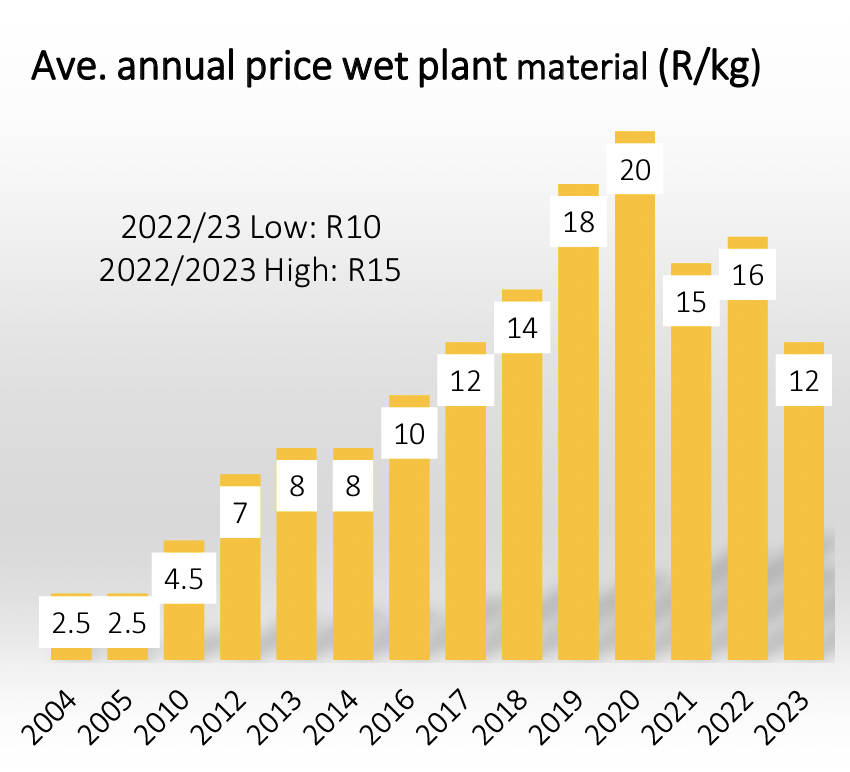

The information presented here is based on averages. Price for wet material varies according to honeybush species and organic status. The highest price is paid for organic wild C. intermedia which has the lowest moisture loss in processing (45%).

Lower prices are paid for cultivated honeybush species, which tend to have higher moisture loss (up to 65%) and may not be organically certified. The wild crop is made up of 85% C. intermedia, 10% C. subternata and 5% other wild harvested species. The cultivated crop is made up of 47% C. subternata, 43% C. longifolia and 10% C. genistoides.

Challenges in the industry

- Compliance and certification requirements are onerous.

- Authorities lack the capacity to deal with compliance further adding to the burden.

- Uncertainty around and slow progress with regard to Aceess and Benefit Sharing (ABS) negotiations hinder growth in the industry.

- The market demand is great but there is a need for a coordinated marketing drive.

- Chemical contamination standards are prohibitive and need to be adjusted to realistic standards for the industry.

- To stabilise quality and reliability of supply there is a need to develop the cultivated sector and reduce pressure on the wild resource.

Employment in the industry

Employment figures per processor range from five to 20 full-time jobs across a range of roles from primary production (cultivation and harvesting) to processing and administrative roles making up a total of 55 fulltime jobs. The breakdown per gender is 40% female and 60% male.

Economic status

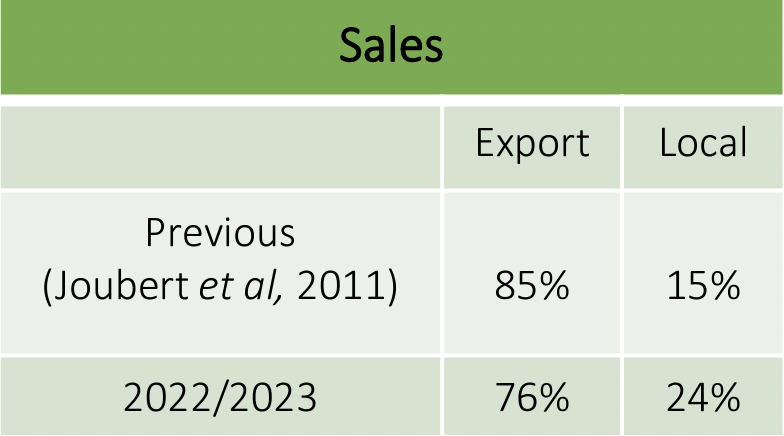

All the processing facilities are privately owned, micro-scale to small commercial scale enterprises. One processor only processes their own wild-harvested material. Three processors only process their own cultivated material. Most processors buyin and process wild harvested and cultivated material, charging a processing toll to return the tea to the producer or selling the processed tea themselves. 50% of processors view the industry as ‘growing,’ while 50% see it as ‘not currently growing.’

Honeybush factfiles and stories

Facts, figures and stories about the honeybush industry.

Complied by SAHTA and invited authors.

Available: www.sahta.com

This document: Honeybush Industry Statistics 2022-2023

Author: G. K. McGregor Date: May 2023